What is a Chapter 13 bankruptcy?

A Chapter 13 bankruptcy is often called a “reorganization.”

It is usually filed if you are behind on your mortgage or automobile payments. An active bankruptcy usually protects you from foreclosure, garnishment, and other creditor actions.

You would file a Chapter 13 to catch up on payments so you can keep your property. You must complete credit counseling within six months before filing. To file for Chapter 13 bankruptcy, you submit a packet of forms that lists your debts and assets. The paperwork includes a plan to repay your creditors over a three- to five-year period. Your plan has to meet the requirements set out in the Bankruptcy Code. The Bankruptcy Court can deny or approve your plan.

Once your plan is approved, your payments go to the Chapter 13 trustee, a person who manages your bankruptcy. The trustee disperses your payments to your creditors.

The good thing about a Chapter 13 bankruptcy is that you generally get to keep your home or car. You have to complete your plan and receive a discharge. A discharge is when you are released from responsibility for certain debts. Note that you do not receive an immediate discharge when you file Chapter 13 bankruptcy. You must make regular payments to the trustee, which requires living on a fixed budget for a long period of time.

You are entitled to a discharge upon completion of all the payments under your Chapter 13 plan and after completing a debtor’s education course.

Upcoming Legal Clinics

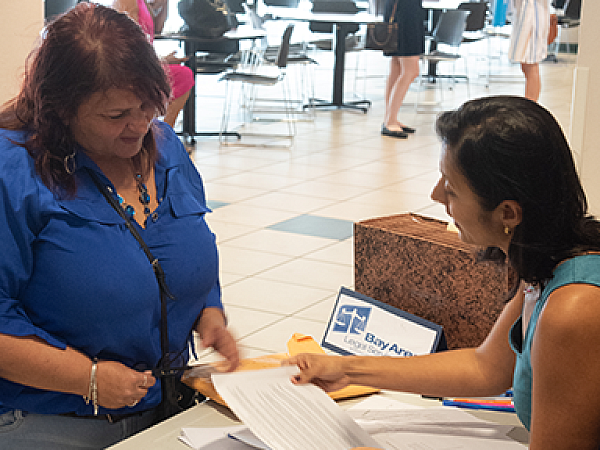

Apply for Services

Apply by phone Monday-Friday, 9 a.m.-4:30 p.m., or apply online anytime for non-emergency legal matters. Language interpreters are available to you at no cost.

Bay Area Legal Services

If you live or have a case in Hillsborough, Pasco, Pinellas, Manatee, or Sarasota counties, we may be able to help.

Statewide Legal Helplines

If you live or have a case in Florida, we may be able to help.